Who is Julia, what is she?

- Started at MIT 2010, mainly seen then as scientific language

- Open-source in 2012 where it's flexibility lead to application in many other fields

- Consists of a Base which is written in Julia

- Base contains all of "numpy", part of "scipy"

- Much of rest is implemented in packages:

- StatsBase

- MultivariateStats

- KernelDensity / KernelEstimator

- Dataframes

- RDatasets

- GLM

- Lora / MCMC

- Clustering

Groups:

JuliaStats, JuliaOpt, JuliaWeb, JuliaQuant, JuliaFinMetriX

JuliaQuant group includes packages such as :

- TimeSeries

- MarketData

- MarketTechnicals

- Quandl

- Ito

- GARCH

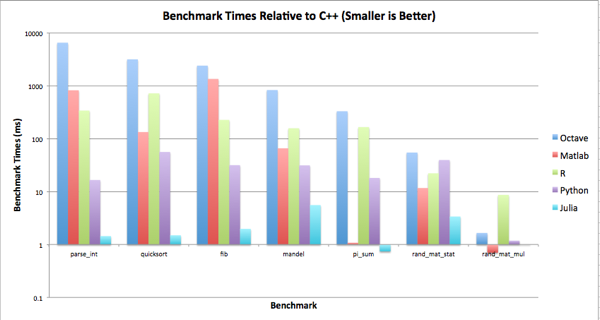

Why is Julia special?

- Julia is written in Julia, down to it's cotton socks

- Uses LLVM / JIT compilation

- Homoiconic design: runtime macros

- Code is uncluttered

- Analysts => developers while remaining within Julia

- Written with parallelism in mind

- Spawn tasks, run asynchoronously

- Can connect with modules / libraries in other programming languages

Interoperability with other languages

- C / Fortran : Built-in to BASE with NO overhead

- Java : JavaCall.jl

- C++ : Cpp.jl, Cxx.jl

- R : RIF.jl, RCall.jl

- Python: PyCall.jl, PyPlot.jl, IJulia.jl, PyJulia.jl

- MATLAB: Matlab.jl, MATLABCluster.jl

In [17]:

using PyCall, PyPlot

In [18]:

using PyCall

@pyimport numpy as np

@pyimport numpy.random as nr

S0 = 100.0;

K = 105.0;

T = 1.0;

r = 0.05;

σ = 0.2;

In [19]:

N = 100000;

w = nr.standard_normal(N);

ST = S0*np.exp((r - 0.5*σ*σ)*T + σ*np.sqrt(T)*w);

hT = np.maximum(ST - K, 0);

C0 = np.exp(-r*T) * np.sum(hT)/N;

@printf "Price of %s option is %6.3f\n" "Call" C0

In [20]:

macroexpand(:(@printf "Price of %s option is %6.3f\n" "Call" C0))

Out[20]:

In [21]:

using PyPlot

@pyimport scipy.interpolate as spi

x = linspace(0,10,10);

y = x .* exp(-0.5x) .* sin(x);

f1 = spi.interp1d(x, y);

f2 = spi.interp1d(x, y, kind="cubic");

In [22]:

xx = linspace(0,10,40);

y1 = pycall(f1,PyAny,xx);

y2 = pycall(f2,PyAny,xx);

plot(x,y,"o",xx,y1,"-", xx, y2,"--");

legend(["data", "linear", "cubic"], loc="best");

In []:

In [26]:

using PyPlot

T = 100;

S0 = 100;

dt = 0.01;

v = 0.2;

r = 0.05;

q = 0.0;

x = linspace(1,T);

S = zeros(Float64,T)

S[1] = S0;

iseed = ccall( (:clock, "libc"), Int32, ());

srand(iseed);

dW = randn(T)*sqrt(dt);

[ S[t] = S[t-1] * (1 + (r - q - 0.5*v*v)*dt + v*dW[t] + 0.5*v*v*dW[t]*dW[t]) for t=2:T ]

plot(x,S)

Out[26]:

In [27]:

function asianOpt(N = 10000; S0=100.0, K=100.0)

# European Asian option.

# Euler and Milstein discretization for Black-Scholes.

r = 0.05; # Risk free rate

q = 0.0; # Dividend yield

v = 0.2; # Volatility

tma = 0.25; # Time to maturity

T = 100; # Number of time steps

dt = tma/T; # Time increment

S = zeros(Float64,T);

A = zeros(Float64,N);

for n = 1:N

S[1] = S0

dW = randn(T)*sqrt(dt);

for t = 2:T

z0 = (r - q - 0.5*v*v)*S[t-1]*dt;

z1 = v*S[t-1]*dW[t];

z2 = 0.5*v*v*S[t-1]*dW[t]*dW[t];

S[t] = S[t-1] + z0 + z1 + z2;

end

A[n] = mean(S);

end

# Define the payoff and calculate price

P = zeros(Float64,N);

[ P[n] = max(A[n] - K, 0) for n = 1:N ];

price = exp(-r*tma)*mean(P);

end

Out[27]:

In [28]:

@printf "Option Price: %10.4f\n\n" asianOpt(K = 102.0);

In [29]:

runs = 1000000

tm = @elapsed asianOpt(runs, K=102.0)

@printf "Elapsed time for %d runs is %7.4f sec.\n\n" runs tm

In [31]:

macroexpand(:(@elapsed asianOpt(runs, K=102.0)))

Out[31]:

In []:

macroexpand(:(@printf "Elapsed time for %d simulations is %7.3f sec.\n\n" runs tm ))

In []:

PyJulia adds a Python 'julia' module

Get source from github and use setup.py

Pkg.add("pyjulia")

cd ~/.julia/v0.3/pyjulia

python setup.py install

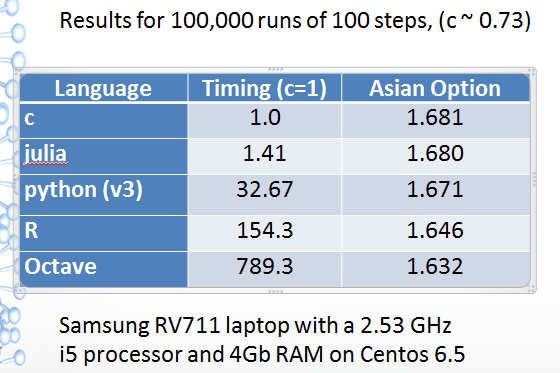

Speeding up Python execution times

$ python

Python 2.7.9 |Anaconda 2.1.0 (x86_64)

[GCC 4.2.1 (Apple Inc. build 5577)] on darwin

>>> import time as tm

>>> start = tm.time()

>>> asianOpt(1000000,K=102.0)

1.6409

>>> print 'It took', tm.time()-start, 'seconds.'

It took 77.332 seconds.

>>> import julia

>>> jl = julia.Julia()

>>> print jl.bessely0(1.5)

0.3824489237977

>>> import numpy as np

>>> print np.sin(0.5) * jl.bessely0(1.5)

0.1833557812803

>>> jl.require("asian-opt")

>>> jl.asianOpt()

AttributeError: 'Julia' object has no attribute 'asianOpt'

>>> jl.eval("asianOpt(1000000,K=102.0)")

1.6775348594420794

>>> jl.eval("@elapsed asianOpt(1000000,K=102.0)")

3.146388532

In []:

$ more myfinx.py

import datetime

import numpy as np

import matplotlib.colors as colors

import matplotlib.finance as finance

import matplotlib.dates as mdates

import matplotlib.ticker as mticker

import matplotlib.mlab as mlab

import matplotlib.pyplot as plt

import matplotlib.font_manager as font_manager

def moving_average(x, n, type='simple'):

"""

compute an n period moving average.

type is 'simple' | 'exponential'

"""

def relative_strength(prices, n=14):

"""

compute the n period relative strength indicator

http://stockcharts.com/school/doku.php?id=chart_school:glossary_r#relativestrengthindex

http://www.investopedia.com/terms/r/rsi.asp

"""

def moving_average_convergence(x, nslow=26, nfast=12):

"""

compute the MACD (Moving Average Convergence/Divergence) using a fast and slow exponential moving avg'

return value is emaslow, emafast, macd which are len(x) arrays

"""

def run(ticker):

startdate = datetime.date(2000,1,1)

today = enddate = datetime.date.today()

............

............

............

plt.show()

In [32]:

using PyCall

@pyimport myfinx as fx

fx.run("MSFT")

- Julia Main Page : http://www.julialang.org

- Julia Wiki Book : https://en.wikibooks.org/wiki/Introducing_Julia

- London Julia UG : http://londonjulia.org

- JuliaStats Group : http://JuliaStats.org

- JuliaOpt Group : http://JuliaOpt.org

- JuliaQuant Group : https://github.com/JuliaQuant

- JuliaFinMetriX : https://github.com/JuliaFinMetriX

- JuliaEconomics : http://juliaeconomics.com/tutorials

- Quant-Econ.net : http://quant-econ.net

- Steven Johnson EuroSciPy 2014 Keynote Speech : https://www.youtube.com/watch?v=jhlVHoeB05A

- Contact ME : malcolm@amisllp.com

In []: